Have you ever wondered, "what branch is my bank?"

Knowing the branch of your bank is essential for several reasons. Firstly, it allows you to access in-person banking services, such as depositing checks, withdrawing cash, and getting assistance with your account.

Secondly, knowing your bank's branch can be helpful if you need to send or receive wire transfers or if you have any issues with your account that require immediate attention. Additionally, some banks offer exclusive services or promotions to customers who visit their local branches.

To find out what branch your bank is, you can check your bank's website or mobile app. You can also call your bank's customer service line and ask for the branch information. Once you know the branch of your bank, you can visit it during regular business hours to conduct your banking transactions.

Here are some tips for finding the right branch for you:

- Consider the location of the branch. You'll want to choose a branch that is convenient for you to get to, whether by car, public transportation, or walking.

- Check the branch's hours of operation. Make sure the branch is open during the times that you need to conduct your banking.

- Read reviews of the branch online. This can give you an idea of what other customers have experienced at the branch.

Once you've found a branch that meets your needs, you can start using it for all of your banking transactions.

What Branch Is My Bank?

Knowing what branch your bank is has several essential aspects:

- Location: The branch's physical address and proximity to your home or workplace.

- Hours: The branch's operating hours, ensuring they align with your availability.

- Services: The specific services offered at the branch, such as deposits, withdrawals, and loan applications.

- Staff: The friendliness, helpfulness, and professionalism of the branch staff.

- Technology: The availability of ATMs, online banking, and other technological conveniences at the branch.

- Security: The branch's security measures to protect your financial information and transactions.

- Convenience: The overall ease of access, parking availability, and comfort of the branch's facilities.

These aspects are interconnected and influence your banking experience. For instance, a branch with convenient hours and a friendly staff can make banking less stressful, while a branch with limited services or poor security may hinder your financial transactions. By considering these key aspects, you can choose the right branch for your specific needs and ensure a smooth and satisfactory banking experience.

1. Location

The location of your bank branch is an important factor to consider when choosing a bank. The branch's physical address and proximity to your home or workplace can have a significant impact on your banking experience.

If you live or work near a branch, you'll be able to easily access your accounts and conduct your banking transactions in person. This can be especially important if you need to make large deposits or withdrawals, or if you have any questions or concerns that you need to discuss with a bank representative.

On the other hand, if you live or work far from a branch, you may find it more difficult to conduct your banking in person. You may have to travel a long distance to get to the branch, and you may have to take time off from work or other activities to do so.

In addition, the location of your bank branch can also affect the fees that you pay. Some banks charge higher fees for branches that are located in convenient locations. It's important to compare the fees charged by different banks before choosing a branch.

When choosing a bank branch, it's important to consider your individual needs and preferences. If you value convenience and accessibility, then you should choose a branch that is located near your home or workplace. However, if you're willing to travel a bit further to get to a branch, you may be able to save money on fees.

2. Hours

The hours of a bank branch are an important factor to consider when choosing a bank. The branch's operating hours should align with your availability, so that you can easily access your accounts and conduct your banking transactions.

If the branch's hours are not convenient for you, you may find it difficult to conduct your banking in person. This could be especially problematic if you need to make large deposits or withdrawals, or if you have any questions or concerns that you need to discuss with a bank representative.

For example, if you work during the day, you may need to choose a bank branch that has extended hours or that is open on weekends. If you travel frequently, you may need to choose a bank branch that is located near your home or office, so that you can easily access your accounts when you are in town.

The hours of a bank branch can also affect the fees that you pay. Some banks charge higher fees for branches that are open longer hours or that are located in convenient locations. It's important to compare the fees charged by different banks before choosing a branch.

When choosing a bank branch, it's important to consider your individual needs and preferences. If you value convenience and accessibility, then you should choose a branch that has hours that align with your availability. However, if you're willing to travel a bit further to get to a branch, you may be able to save money on fees.

3. Services

The services offered at a bank branch play a crucial role in determining its relevance and usefulness to customers. In the context of "what branch is my bank," understanding the services available at different branches can help individuals choose the branch that best meets their specific banking needs.

- Deposits and Withdrawals:

The ability to make deposits and withdrawals is a fundamental service offered at bank branches. This allows customers to add money to their accounts, withdraw cash, and manage their financial transactions. The availability of these services at a convenient branch location is essential for customers who prefer in-person banking.

- Loan Applications:

Many bank branches offer loan application services. This enables customers to apply for various types of loans, such as personal loans, mortgages, and business loans. Having access to loan application services at a branch allows customers to receive personalized assistance and guidance throughout the loan application process.

- Financial Advice:

Some bank branches provide financial advice services to their customers. This includes guidance on investment strategies, retirement planning, and other financial matters. Customers can benefit from the expertise of financial advisors at the branch, helping them make informed decisions about their finances.

- Safe Deposit Boxes:

Certain bank branches offer safe deposit box services. These boxes provide customers with a secure place to store valuable items, such as jewelry, important documents, and heirlooms. The availability of safe deposit boxes at a branch can be a valuable service for customers seeking additional security measures for their belongings.

The services offered at a bank branch are diverse and tailored to meet the varied needs of customers. By understanding the services available at different branches, individuals can make an informed decision about which branch to choose, ensuring that it aligns with their specific banking requirements.

4. Staff

The friendliness, helpfulness, and professionalism of the branch staff play a pivotal role in determining the overall banking experience for customers. In the context of "what branch is my bank," it is crucial to consider the quality of staff interactions when choosing a branch that aligns with individual preferences and expectations.

- Customer Service:

Excellent customer service is paramount. Branch staff should be approachable, attentive, and genuinely interested in assisting customers with their banking needs. A welcoming and supportive staff can make a significant difference in building rapport and fostering long-term relationships with customers.

- Expertise and Knowledge:

Knowledgeable staff is essential. Branch staff should be well-versed in banking products and services, as well as industry regulations. Their ability to provide accurate and up-to-date information can help customers make informed decisions and navigate complex financial matters.

- Problem-Solving Skills:

Effective problem-solving skills are invaluable. Branch staff should be able to handle customer concerns and queries promptly and efficiently. Their ability to find solutions and resolve issues can enhance customer satisfaction and foster trust.

- Professional Demeanor:

A professional demeanor is crucial. Branch staff should maintain a courteous and respectful attitude at all times. Their appearance, language, and body language should reflect the professional standards of the bank and contribute to a positive banking environment.

By considering the friendliness, helpfulness, and professionalism of the branch staff, customers can make an informed decision about which branch to choose. A branch with a well-trained and dedicated staff can provide a positive and supportive banking experience, building stronger relationships between customers and their financial institution.

5. Technology

Technological advancements have significantly transformed the banking landscape. In the context of "what branch is my bank," the availability of ATMs, online banking, and other technological conveniences at a branch plays a crucial role in enhancing customer experience and convenience.

ATMs, or automated teller machines, provide 24/7 access to cash withdrawals, deposits, and other basic banking transactions. This eliminates the need to visit a branch during regular business hours, offering greater flexibility and convenience to customers.

Online banking has become increasingly popular, allowing customers to manage their accounts, pay bills, and transfer funds from the comfort of their own homes or offices. By integrating online banking with mobile apps, customers can access their bank accounts anytime, anywhere, using their smartphones or tablets.

Other technological conveniences, such as interactive teller machines (ITMs) and video banking, further enhance the banking experience. ITMs allow customers to conduct more complex transactions, such as applying for loans or opening new accounts, without having to visit a traditional teller. Video banking enables customers to connect with a remote teller via video conference, providing personalized assistance for various banking needs.

The availability of these technological conveniences at a branch complements the traditional in-person banking experience. Customers can choose the channel that best suits their needs, whether it's the convenience of an ATM, the flexibility of online banking, or the personal touch of a video banking session.

In conclusion, the integration of technology at bank branches has revolutionized the way customers interact with their financial institutions. The availability of ATMs, online banking, and other technological conveniences empowers customers with greater control over their finances, enhances their banking experience, and makes banking more accessible and convenient than ever before.

6. Security

When choosing a bank branch, it's important to consider the security measures in place to protect your financial information and transactions. These measures can vary from branch to branch, so it's important to do your research before choosing a branch.

- Physical security:

The branch should have adequate physical security measures in place, such as security cameras, alarms, and guards. This will help to deter crime and protect your financial information.

- Cybersecurity:

The branch should have strong cybersecurity measures in place to protect your financial information from online threats. This includes measures such as firewalls, intrusion detection systems, and encryption.

- Employee training:

The branch's employees should be well-trained in security procedures. This will help to prevent them from making mistakes that could compromise your financial information.

- Customer awareness:

The branch should provide customers with information about how to protect their financial information. This includes tips on how to create strong passwords, avoid phishing scams, and protect their identity.

By considering the security measures in place at a bank branch, you can help to protect your financial information and transactions. This will give you peace of mind and help you to avoid becoming a victim of fraud.

7. Convenience

Convenience is an important factor to consider when choosing a bank branch. The overall ease of access, parking availability, and comfort of the branch's facilities can have a significant impact on your banking experience.

If a branch is difficult to get to, has limited parking, or is uncomfortable, you may be less likely to visit it. This can make it more difficult to conduct your banking transactions and manage your finances.

On the other hand, a branch that is easy to get to, has ample parking, and is comfortable will make it more likely that you will visit it. This can make it easier to conduct your banking transactions and manage your finances.

Here are some specific examples of how convenience can impact your banking experience:

- If a branch is located near your home or workplace, you may be more likely to visit it to make deposits or withdrawals.

- If a branch has ample parking, you may be more likely to visit it to conduct more complex transactions, such as opening a new account or applying for a loan.

- If a branch is comfortable and inviting, you may be more likely to visit it to discuss your financial goals with a banker.

When choosing a bank branch, it is important to consider your individual needs and preferences. If convenience is important to you, then you should choose a branch that is easy to get to, has ample parking, and is comfortable.

By considering all of these factors, you can choose the right bank branch for your needs and have a more positive banking experience.

FAQs on "What Branch is My Bank?"

This section provides answers to frequently asked questions about determining the branch associated with your bank account.

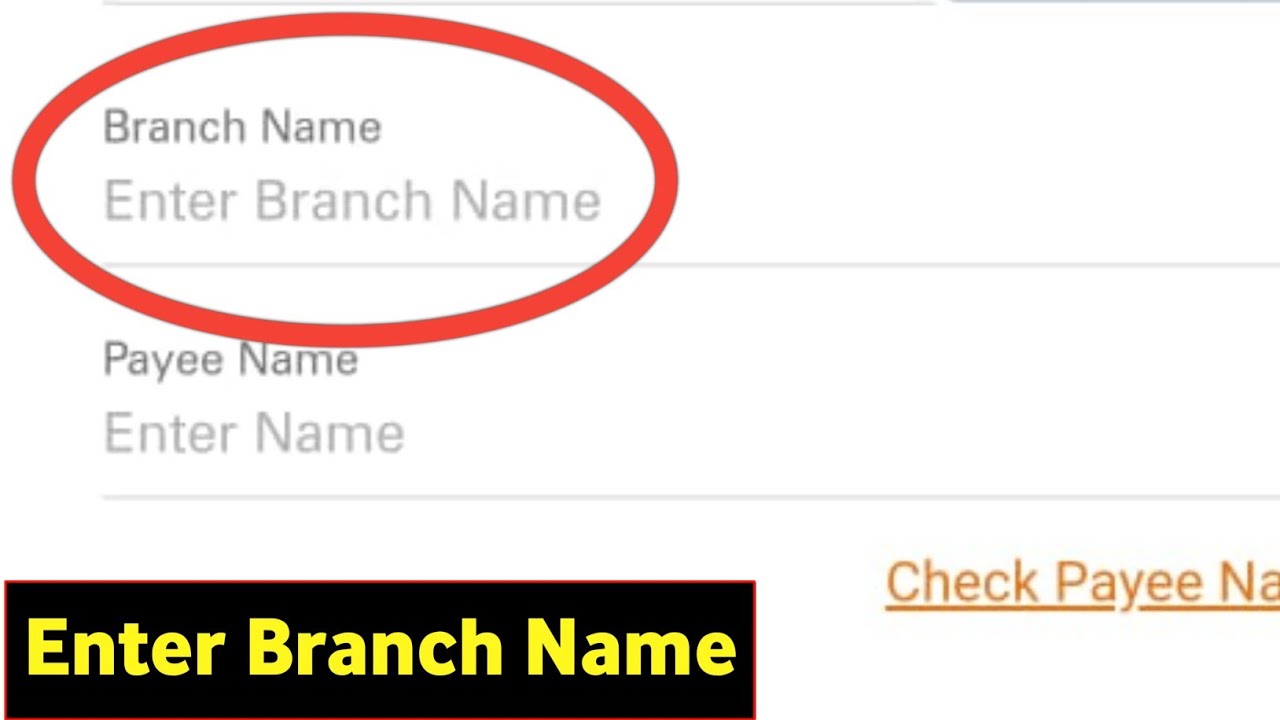

Question 1: How can I find out what branch my bank is?

There are several ways to determine your bank's branch:

- Check your bank's website or mobile app.

- Call your bank's customer service line.

- Visit your local bank branch and inquire with a customer service representative.

Question 2: Why is it important to know my bank's branch?

Knowing your bank's branch is essential for several reasons:

- Access to in-person banking services, such as cash deposits and withdrawals.

- Assistance with account-related queries or issues.

- Exclusive services or promotions offered by some banks to customers visiting their local branches.

Question 3: What factors should I consider when choosing a bank branch?

When selecting a bank branch, consider factors such as:

- Location and proximity to your residence or workplace.

- Operating hours that align with your availability.

- Services offered at the branch, such as deposits, withdrawals, and loan applications.

- Convenience features like ATMs, online banking, and mobile banking.

- Security measures implemented to protect your financial information.

Question 4: How can I ensure the security of my financial information when visiting a bank branch?

To ensure the security of your financial information, consider the following precautions:

- Be cautious of unsolicited requests for personal or financial information.

- Avoid using public Wi-Fi networks for banking transactions.

- Check for security features like security cameras and guards within the branch.

- Report any suspicious activity or unauthorized transactions immediately to your bank.

Question 5: Are there any alternatives to visiting a physical bank branch?

Yes, there are several alternative options available:

- Online banking: Manage your accounts and conduct transactions online.

- Mobile banking: Access your accounts and perform banking tasks using a mobile banking app.

- ATMs: Withdraw cash, deposit checks, and perform other basic transactions at automated teller machines.

Conclusion

Understanding the concept of "what branch is my bank" is essential for managing your finances effectively. By knowing the location and services offered by your bank branch, you can conveniently access your accounts, conduct transactions, and seek assistance when needed.Choosing the right bank branch involves considering factors such as proximity, operating hours, available services, and security measures. It is also important to be aware of alternative banking options, such as online banking, mobile banking, and ATMs, which provide flexibility and convenience.Remember to prioritize the security of your financial information by being cautious of unsolicited requests, avoiding public Wi-Fi networks for banking, and reporting any suspicious activity promptly.By staying informed and making informed decisions, you can ensure a seamless and secure banking experience that meets your specific needs and preferences.Related Resources:

Detail Author:

- Name : Virgie Lubowitz

- Username : marcus.erdman

- Email : alford.swaniawski@hotmail.com

- Birthdate : 1981-04-14

- Address : 7351 Reichel Expressway New Herminio, NH 68022

- Phone : 737.282.7761

- Company : Walsh, Turcotte and Ritchie

- Job : Fitter

- Bio : Dolores quas et numquam eligendi ducimus officia. Asperiores quis quo dolorem soluta. Dolores possimus fugit totam et ex.

Socials

twitter:

- url : https://twitter.com/schillerj

- username : schillerj

- bio : Necessitatibus qui qui labore molestiae laudantium ut nihil. Dolores voluptate unde cumque eligendi unde.

- followers : 1780

- following : 2521

tiktok:

- url : https://tiktok.com/@jules_schiller

- username : jules_schiller

- bio : Et nobis et vel quos dolorem.

- followers : 6764

- following : 528

facebook:

- url : https://facebook.com/jules_official

- username : jules_official

- bio : Magni illo ut cum rerum quia nemo.

- followers : 6446

- following : 890